Published October 5, 2023

Part 2: Buying a Home in Walker County, Alabama - Tips and Insights

In the first part of our series, we provided an overview of Walker County, Alabama, and its diverse real estate landscape. Now, in Part 2, we'll focus on potential homebuyers who are considering making this charming region their new home. Whether you're a first-time buyer or a seasoned homeowner, here are some key insights and tips to help you navigate the Walker County real estate market.

The Current State of Residential Real Estate

Before delving into the specifics of buying a home in Walker County, it's crucial to understand the current state of the residential real estate market. As of our last update in September 2023, Walker County has experienced a stable and moderately competitive housing market.

Here are some key insights:

Affordability: One of the significant advantages of buying a home in Walker County is affordability. Compared to some neighboring areas, housing prices in Walker County are relatively lower, making it an attractive option for those looking to purchase their first home or upgrade to a larger property.

Inventory Levels: While housing inventory in Walker County may not be as extensive as in larger metropolitan areas, there are typically enough options to meet the demand. It's essential to work with a local real estate agent who has access to the most up-to-date listings.

Home Styles: Walker County offers a wide variety of home styles, from historic properties with character to modern single-family homes and spacious rural estates. Your choice will depend on your preferences and budget.

Average Home Prices and Trends

To get a better sense of the market, let's discuss average home prices and recent trends. Keep in mind that these figures can change over time, so it's crucial to consult with a local real estate professional for the most current information.

As of our last update in September 2023, the average home price in Walker County ranged from $100,000 to $200,000, depending on the location and property type. However, prices can vary significantly within the county.

The market has shown stability with modest appreciation in recent years, making it an attractive option for long-term homeowners.

Tips for First-Time Homebuyers in Walker County

If you're a first-time homebuyer in Walker County, here are some tips to help you navigate the process:

Get Pre-Approved: Before you start house hunting, get pre-approved for a mortgage. This will help you determine your budget and make your offers more attractive to sellers.

Work with a Local Realtor: An experienced local real estate agent can provide valuable insights into the market, guide you through the buying process, and help you find the right property.

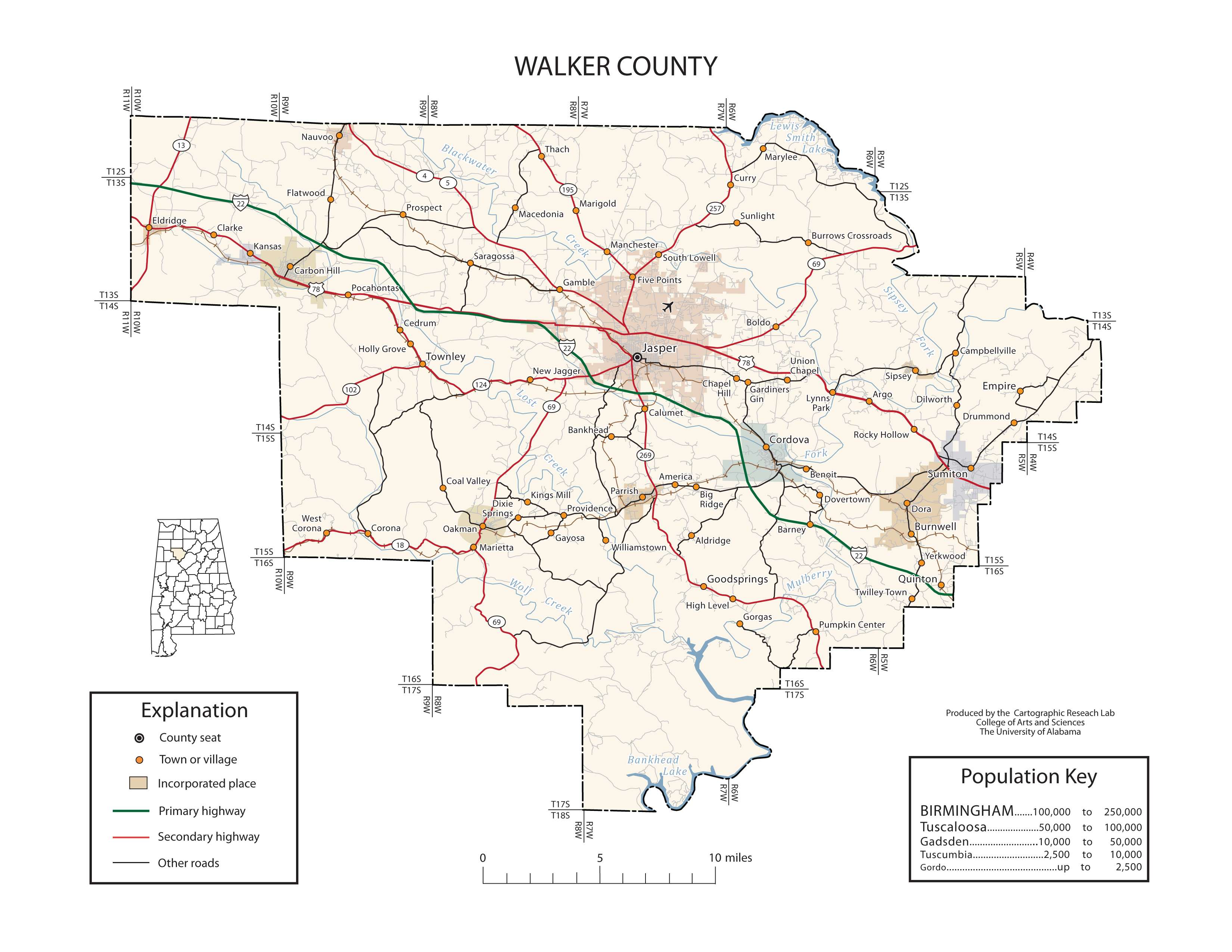

Explore Different Neighborhoods: Walker County offers a variety of neighborhoods and communities. Explore different areas to find the one that suits your lifestyle and preferences.

Consider Future Growth: Research potential growth and development plans in the area, as this can impact property values and your long-term investment.

Inspect Thoroughly: When you find a property you like, don't skip the inspection. A professional inspection can uncover any issues that may affect your decision.

Buying a home is a significant milestone, and in Walker County, it can be a rewarding and affordable experience. Stay tuned for Part 3 of our series, where we'll explore selling your property in Walker County, including tips and strategies for success in this market.